- Introduction to AMC Stonk-O-Tracker

- The Power of a Stock Tracker

- Wall Street Bets: The Catalyst

- The Evolution of Stock Trading

- Portfolio Management in the Meme Stock Era

- Understanding the Stock Exchange through AMC

- Embracing the Buy and Hold Strategy

- Tracking AMC’s Stock Performance

- Hedge Fund Shorting: The Other Side of the Coin

- The Importance of Investment Strategies

- Conclusion: The Future of AMC and Stonk-O-Tracker

- FAQ

Introduction to AMC Stonk-O-Tracker

In the realm of online trading platforms, an intriguing trend has come to prominence—stonk-o-tracker AMC. Stonk is an intentional misspelling of the word “stock,” often used to reference stocks that are experiencing unusually high trading volumes. The AMC Stonk-O-Tracker is a tool that specifically tracks AMC Theatres’ stock, providing real-time data on trading volume, short interest, and other relevant metrics. Retail investors have found it incredibly useful in navigating the volatility of AMC’s stock price.

The Power of a Stock Tracker

The AMC Stonk-O-Tracker has cemented its position as a potent stock tracker in the world of securities trading. It provides data on the number of shares being traded, options data, and the available shares for shorting. This real-time data helps traders understand the market’s momentum and sentiment, enabling them to make timely decisions.

Wall Street Bets: The Catalyst

The discussion forum on Reddit, “Wall Street Bets”, has made a considerable impact on the stock market. The users of this forum, largely retail investors, have used it as a platform to propel stocks like AMC to astronomical heights, defying traditional market analysis and predictions.

The Evolution of Stock Trading

Stock trading has seen an evolution with the advent of online trading platforms and tools like Stonk-O-Tracker AMC. The old barriers that made trading a venture only for the well-off have been dismantled, allowing anyone with internet access to participate in trading securities.

Portfolio Management in the Meme Stock Era

In this meme stock era, portfolio management has become more challenging yet exciting. Investors must now consider the potential impact of stocks like AMC on their portfolio balance and risk profile. Using tools like the Stonk-O-Tracker can provide invaluable insight into the real-time performance of these volatile stocks.

Understanding the Stock Exchange through AMC

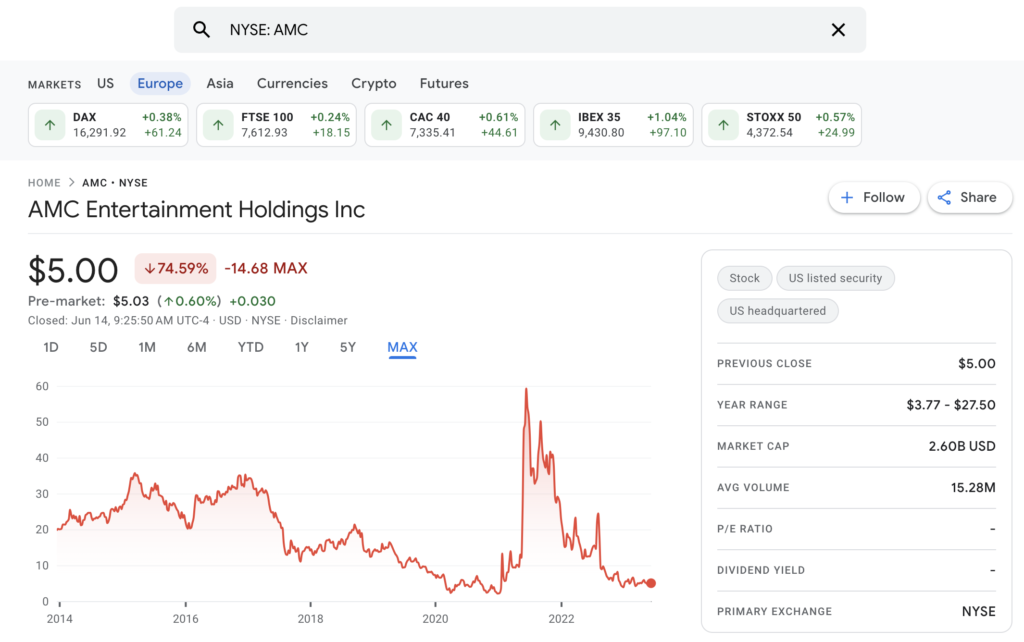

The journey of AMC on the stock exchange serves as a case study for understanding market mechanics. From being on the brink of bankruptcy to becoming one of the most traded stocks, the incredible rise of AMC demonstrates the influence of retail investors and social media on the stock market.

Embracing the Buy and Hold Strategy

The ‘Buy and Hold’ strategy has been widely adopted by many AMC investors. Despite the stock’s extreme volatility, these investors have chosen to buy and hold AMC shares with the hope of a significant price surge in the future.

Tracking AMC’s Stock Performance

AMC’s stock performance has been nothing short of a rollercoaster ride. From dramatic surges to steep drops, AMC’s performance continues to defy market expectations. The Stonk-O-Tracker allows investors to monitor these fluctuations and make informed decisions accordingly.

Hedge Fund Shorting: The Other Side of the Coin

Hedge funds shorting AMC and other similar stocks have found themselves on the receiving end of a massive short squeeze. As retail investors rallied behind these stocks, hedge funds were forced to cover their positions at much higher prices, leading to significant losses.

The Importance of Investment Strategies

The saga of AMC has highlighted the importance of having solid investment strategies. Whether it’s a high-risk, high-reward approach or a more conservative strategy, understanding the market and using tools like the Stonk-O-Tracker can help investors navigate the market more effectively.

Conclusion: The Future of AMC and Stonk-O-Tracker

As the internet-based investing communities continue to grow, so does the popularity of tools like Stonk-O-Tracker. The rise of AMC shareholders and their impact on the stock market has led to a new form of market analysis that takes into account retail trader sentiment analysis. It’s clear that platforms like Stonk-O-Tracker are contributing significantly to this new era of trading. The market sentiment among these retail traders continues to be bullish, promising more exciting times ahead for the AMC stock.

As investors continue to navigate the market using real-time stock tracking, the financial market indicators provided by Stonk-O-Tracker will become even more relevant. In this rapidly evolving world of equity investments and stock market predictions, one thing is for sure: AMC and the stonk-o-tracker have changed the game.

The role of the retail investor in the stock market is growing, and with it, so is the need for accessible, easy-to-understand, and real-time market data. While the future of AMC’s share price remains uncertain, the influence of retail investors is unquestionable. The Stonk-O-Tracker AMC is more than a mere tool; it’s a symbol of this new wave of investment democratization, a beacon for the individual investor in a sea of institutional giants.

As retail investors arm themselves with platforms like Stonk-O-Tracker, they are reshaping the dynamics of the stock exchange. They are demonstrating that with the right tools and a united front, they too can influence market trends and put Wall Street heavyweights on their toes.

What’s more, these developments are prompting serious conversations about traditional investment strategies. The incredible volatility and stock performance of AMC, driven in large part by social media and internet-based investment communities, have challenged long-standing investment doctrines. Many investors are now embracing a more dynamic approach to managing their portfolios, one that includes ‘meme stocks’ and utilizes the power of platforms like Stonk-O-Tracker.

In conclusion, the AMC Stonk-O-Tracker saga represents the intersection of technology, social media, and finance. It’s a testament to the shifting landscape of the financial world, driven by internet communities and a new generation of retail investors. Regardless of where AMC’s share price heads in the future, one thing is abundantly clear: the Stonk-O-Tracker, and the movement it symbolizes, is here to stay. It has opened the door to a new era of trading, making the stock market more accessible and democratic than ever before.

FAQ

What is the Stonk-O-Tracker AMC?

The Stonk-O-Tracker AMC is a tool specifically designed to provide real-time tracking and data analysis for AMC Theatres’ stock. It’s a vital resource for retail investors interested in the stock’s trading volume, short interest, and other related metrics.

What is the role of Wall Street Bets in the AMC stock trend?

Wall Street Bets, a subreddit, has significantly influenced the AMC stock trend. This forum is known for its discussions on high-risk stocks and has been instrumental in rallying retail investors to drive up the price of AMC shares.

What is the impact of the Stonk-O-Tracker AMC on stock trading?

The Stonk-O-Tracker has revolutionized stock trading by providing real-time data, which helps investors make timely and informed decisions. It’s particularly valuable for navigating the volatility of AMC’s stock.

How has the Stonk-O-Tracker influenced portfolio management?

In the era of meme stocks, portfolio management has become both challenging and exciting. Tools like the Stonk-O-Tracker provide crucial insights into the performance of these volatile stocks, helping investors manage their portfolios more effectively.

How does the Stonk-O-Tracker AMC affect investment strategies?

The Stonk-O-Tracker has highlighted the importance of adaptable investment strategies. It provides real-time data that can help investors navigate market fluctuations and inform their investment decisions.

What does the future hold for AMC and the Stonk-O-Tracker?

The popularity of the Stonk-O-Tracker is expected to grow alongside the rise of internet-based investment communities. As retail investors continue to influence the stock market, tools like the Stonk-O-Tracker will remain pivotal in tracking and analyzing market trends.