Figure out what estimating means for business choices. Investigate its importance, techniques, and advantages for viable preparation and development.

In the always advancing universe of business, remaining on the ball is vital. One key instrument that helps this try is anticipating. Whether foreseeing deals patterns, asset portion, or market shifts, estimating assumes a critical part in informed direction. In this article, we’ll dig into the profundities of anticipating, its different systems, and its significant effect on current business methodologies.

Presentation

Estimating, the craft of foreseeing future patterns in view of verifiable information and examination, enables associations to expect difficulties, gain by open doors, and adjust their techniques as needs be. The exactness of conjectures can fundamentally impact a business’ main concern, making it a fundamental part of key preparation. Powerful estimating can be the distinction between outflanking contenders and battling to remain above water.

Chapter by chapter list

Chapter by chapter list

- Significance of Estimating

- Kinds of Anticipating Strategies

- The Advantages of Accurate Forecasts Challenges in Anticipating

- Information Assortment and Examination

- Request Determining in Business

- Budgeting and planning for finances Innovation’s Part in Anticipating

- Tenth, Ethical Considerations Ecological Variables

Significance of Estimating

Estimating furnishes organizations with important experiences that guide in basic navigation. Companies are able to anticipate market fluctuations, shifts in demand, and changes in the economy by analyzing historical data and recognizing patterns. Proactive responses are made possible by this data, which ensures that potential risks are reduced and resources are distributed effectively.

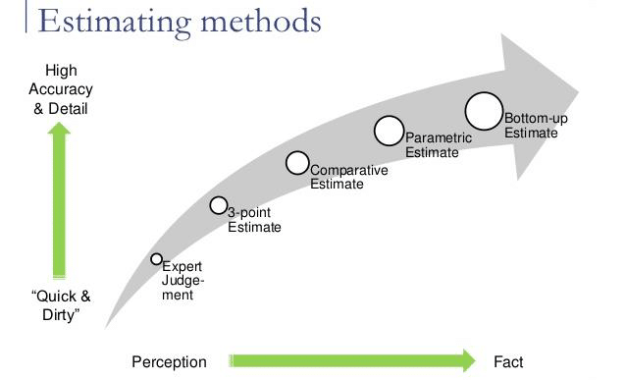

Kinds of Determining Strategies business

Different techniques, for example, subjective, quantitative, time-series examination, and causal models, offer alternate points of view on anticipating. Subjective strategies depend on well-qualified suppositions, while quantitative techniques include factual procedures. Time-series investigation utilizes verifiable information to foresee future examples, and causal models inspect circumstances and logical results connections.

Benefits of Accurate Forecasts Accurate forecasts make financial planning, production scheduling, and inventory management simpler. Based on anticipated demand, businesses can plan their marketing strategies, allocate resources effectively, and avoid stockouts or overstocking. Profitability rises and customer satisfaction rises as a result.

Problems with Forecasting Forecasting has its problems. Outer elements like political occasions and cataclysmic events can upset expectations. Furthermore, market patterns can be eccentric, and choosing the proper anticipating strategy can be mind boggling. Finding some kind of harmony among confidence and traditionalism is urgent.

Information Assortment and Examination

The underpinning of compelling estimating lies in information assortment and examination. Verifiable information should be precise, important, and appropriately coordinated. High level insightful instruments and advancements, for example, AI calculations, improve the exactness of expectations by recognizing many-sided designs inside the information.

Request estimating assists organizations

Request estimating assists organizations with adjusting their creation and inventory network with expected client interest. Companies can optimize inventory levels, reduce carrying costs, and enhance overall operational efficiency by accurately anticipating demand for goods and services.

Forecasting is an essential component of financial planning and budgeting. It helps with making practical spending plans, putting forth feasible monetary objectives, and overseeing incomes. Businesses can strategically allocate funds and make well-informed investment decisions with accurate financial forecasting.

The Impact of Technology on Forecasting Forecasting has been transformed by technological advancements. Large information examination, man-made reasoning, and AI empower organizations to rapidly handle tremendous measures of data. These innovations upgrade the precision of forecasts and give ongoing experiences, giving organizations an upper hand.

Moral Contemplations

While estimating offers enormous advantages, moral contemplations should not be neglected. Decision-making can become skewed if forecasts are relying too much on them. It’s fundamental to keep up with straightforwardness, utilize solid information sources, and think about the likely results of acting exclusively on expectations.

Natural Variables

Natural variables, for example, administrative changes, maintainability concerns, and cultural movements, influence business gauges. Adjusting to these progressions requires readiness and an eagerness to change methodologies in view of developing conditions.

FAQs

What is the main role of guaging in business?

Businesses can use forecasting to anticipate future trends and make well-informed decisions to achieve their strategic objectives.

How do qualitative and quantitative forecasting approaches differ from one another?

Qualitative methods involve expert opinions and subjective insights, whereas quantitative methods rely on statistical data and analysis.

Will estimating dispense with all dangers for a business?

No, anticipating can alleviate chances, however unexpected outside elements can in any case affect results.

For what reason is precise information essential for viable guaging?

Predictions that are based on accurate data are guaranteed to accurately reflect actual trends and patterns.

Which job does innovation play in present day estimating?

Innovation, for example, computer based intelligence and enormous information investigation, improves guaging precision and gives constant experiences.

How might organizations adjust to unexpected market moves that were not anticipated?

Strategies should be flexible enough to allow businesses to pivot and adjust in the event of unforeseen changes.

Does forecasting raise any ethical questions?

Yes, unethical decisions can result from excessive reliance on forecasts without considering potential biases or consequences.

What effect do natural elements have on business conjectures?

Forecasts can be thrown off by environmental factors, so businesses need to be flexible and responsive.

Is forecasting as beneficial to small businesses as it is to large corporations?

Indeed, estimating is advantageous for organizations of all sizes, helping them plan actually and pursue informed decisions.

How often ought to companies update their forecasts?

The industry and the rate of change determine the frequency of forecast updates; in any case, customary updates are for the most part fitting.

In conclusion, effective business strategy still relies heavily on forecasting. Accurate forecasting enables businesses to navigate the complexities of the contemporary business landscape, from predicting market trends to optimizing resource allocation. By tackling the force of authentic information, cutting edge innovations, and master bits of knowledge, organizations can pursue very much educated choices that drive development and achievement.

Calling all digital enthusiasts! This website is a game-changer. See for yourself: https://nezacdigital.com/shop/