In the fast-paced world of e-commerce, payment options play a pivotal role in shaping the shopping experience. Among the myriad of choices, Buy Now, Pay Later (BNPL) services have gained immense popularity, and at the forefront of this revolution is Sezzle.

Introduction

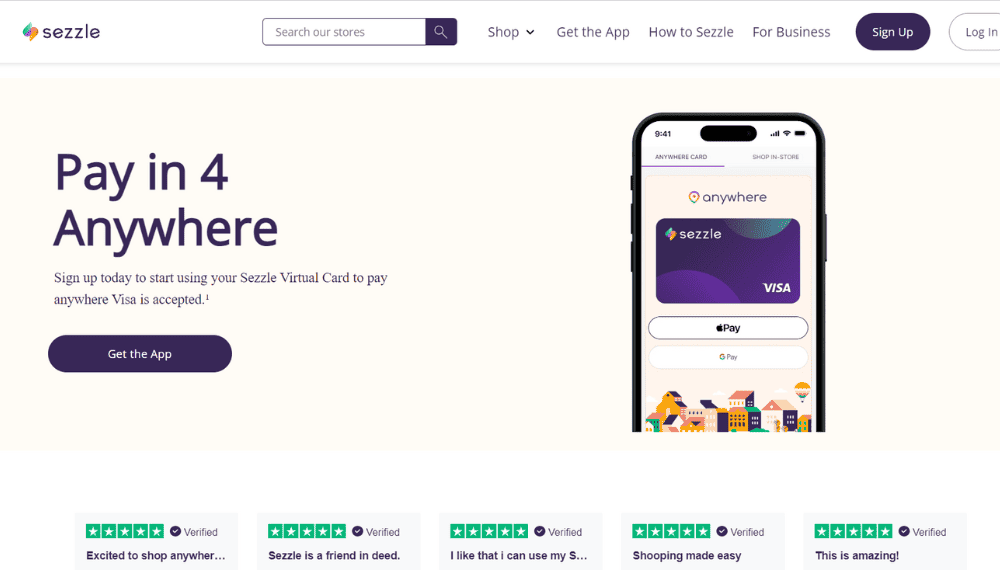

Sezzle is a BNPL platform that allows users to make purchases and pay for them in installments, providing a flexible alternative to traditional payment methods.

Importance of Flexible Payment Options

With changing consumer preferences, the demand for flexible payment options has skyrocketed. Sezzle addresses this need by offering a convenient and accessible way to shop without immediate financial strain.

The Rise of Buy Now, Pay Later (BNPL)

BNPL services enable consumers to buy products and pay for them over time, often with no interest. This has become a game-changer in the e-commerce landscape.

Sezzle’s Role in the BNPL Market

Sezzle has carved a niche for itself by providing a seamless and user-friendly BNPL experience, distinguishing it from other players in the market.

How Sezzle Works

Signing up for Sezzle is a straightforward process, and the quick approval system ensures users can start shopping right away.

Integration with Online Retailers

Sezzle integrates seamlessly with various online retailers, offering users the flexibility to choose it as a payment option during checkout.

Financial Flexibility

Sezzle allows users to split their purchases into interest-free installments, making high-value items more affordable.

Increased Conversion Rates for Merchants

Merchants partnering with Sezzle often experience higher conversion rates as the BNPL option appeals to a broader consumer base.

Potential Drawbacks

While Sezzle promotes interest-free payments, users should be aware of potential fees associated with missed payments.

Impact on Impulse Buying

The ease of BNPL services like Sezzle may lead to impulsive purchases, affecting users’ financial planning.

Sezzle vs. Competitors

A closer look at Sezzle’s features and offerings compared to its competitors reveals its unique advantages.

Unique Features of Sezzle

Sezzle stands out with features such as personalized payment schedules and a straightforward approval process.

Sezzle’s Impact on E-commerce

The adoption of BNPL services like Sezzle has influenced how consumers approach online shopping, emphasizing convenience.

Boosting Sales for Small Businesses

Sezzle has become a lifeline for small businesses, enhancing their sales potential by offering flexible payment solutions.

Payment Security

Sezzle prioritizes the security of user payments, employing robust encryption and authentication measures.

Data Protection

Users can trust Sezzle with their personal and financial information, thanks to stringent data protection measures.

User Feedback and Reviews

Users share positive experiences of using Sezzle, praising its ease of use and impact on their purchasing decisions.

Addressing Common Concerns

Sezzle addresses common concerns raised by users, fostering transparency and trust.

Integration Challenges for Businesses

While Sezzle is beneficial, businesses may face challenges during the integration process on their e-commerce platforms.

Overcoming Potential Issues

Proactive measures can help businesses overcome potential issues, ensuring a smooth integration of Sezzle.

Future Trends in BNPL

Experts predict continued growth in the BNPL market, with Sezzle poised to play a significant role.

Technological Advancements in Payment Systems

Sezzle remains at the forefront of innovation, adapting to technological advancements to enhance user experiences.

Sezzle’s Social Responsibility

Sezzle actively engages in social responsibility initiatives, contributing to various community causes.

B. Community Engagement

Sezzle’s commitment to community engagement sets a positive example in the financial technology sector.

Successful Implementation Stories

Real-world case studies highlight successful partnerships between Sezzle and businesses, showcasing the tangible benefits.

Learning from Challenges

Examining challenges faced by Sezzle in certain cases offers insights into continual improvement.

Conclusion

Summarizing the Impact of Sezzle

In conclusion, Sezzle has revolutionized online payments, offering a convenient and flexible solution that benefits both consumers and businesses.

Looking Ahead to the Future of BNPL

As BNPL continues to evolve, Sezzle’s commitment to innovation positions it as a key player in shaping the future of online payments.

Frequently Asked Questions (FAQs)

How secure is Sezzle as a payment option?

Sezzle prioritizes security, employing advanced encryption and authentication measures to protect user payments.

Can Sezzle be used for all types of online purchases?

Yes, Sezzle can be used for a wide range of online purchases, providing flexibility across various industries.

What sets Sezzle apart from other BNPL services?

Sezzle stands out with personalized payment schedules, a quick approval process, and a commitment to user transparency.

Are there any hidden fees with Sezzle?

While Sezzle promotes interest-free payments, users should be aware of potential fees associated with missed payments.

How does Sezzle benefit small businesses?

Sezzle enhances sales potential for small businesses by offering flexible payment solutions, attracting a broader customer base.