In today’s digital age, AI in banking and finance is increasingly used as a strategic tool to enhance customer service and streamline operations. In this article, we will delve into the art of effectively Chatbot Integration within the financial sector, exploring the benefits and best practices that ensure a seamless and efficient customer experience.

Best Practises of Using AI Chatbots For Banking

- Personalization: Tailor responses to individual customer needs.

- Security: Ensure robust data protection and encryption.

- Compliance: Comply with financial regulations and privacy laws.

- 24/7 Availability: Provide round-the-clock customer support.

- Seamless Integration: Integrate with existing systems for efficiency.

- Human Backup: Offer a seamless transition to human agents when needed.

- Continuous Learning: Train chatbots with updated financial knowledge.

- Multilingual Support: Chatbot Integration to diverse customer bases.

- Performance Monitoring: Track and improve chatbot performance.

- User Feedback: Collect feedback to refine chatbot interactions.

Types of Chatbots in the Financial Sector Chatbot Integration

Transactional Chatbots

These chatbots are designed to handle simple transactions like balance inquiries, fund transfers, and bill payments.

Advisory Chatbots

Focused on providing financial advice, these chatbots can help with investment options, budget planning, and retirement savings.

Customer Service Chatbots

These chatbots are geared towards resolving customer queries and complaints, offering a more interactive and responsive service experience.

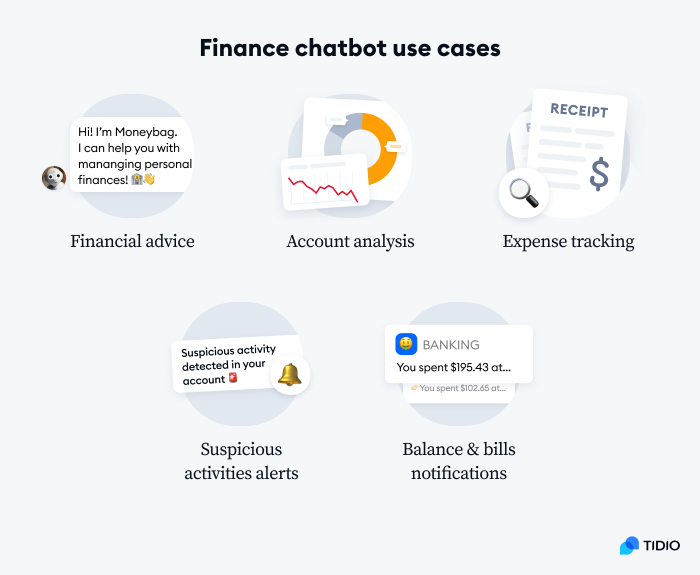

Applications of Chatbots in Financial Services

Account Management

Chatbots can facilitate quick access to account information, including balances, transaction history, and credit scores Chatbot Integration .

Fraud Detection

Advanced AI algorithms enable chatbots to monitor suspicious activities and alert both the institution and the customer immediately.

Onboarding

Chatbots can streamline the onboarding process for new customers by collecting necessary information and guiding them through various steps Chatbot Integration .

Challenges and Concerns

Data Privacy

With increasing concerns about data breaches, ensuring the security and confidentiality of customer data is a significant challenge.

Interpretation Errors

Misinterpreting customer queries can lead to unsatisfactory service and could potentially harm the financial institution’s reputation.

Why OmiSoft?

Choose OmiSoft as your chatbot development agency because our experienced team has developed numerous innovative solutions tailored to companies in your industry. With a track record of success and a deep understanding of the unique challenges and opportunities you face, we’re your trusted partner for cutting-edge solutions that drive growth and efficiency.

Conclusion

The integration of chatbots in the financial services sector offers a plethora of advantages, ranging from enhanced customer experience to operational efficiency. However, it’s crucial to follow best practices and address potential challenges effectively. Partnering with a specialized development agency like OmiSoft can help financial institutions realize the full potential of chatbots, making them an invaluable asset in today’s digital age.