5 Must-Have Stages of Product Development Lifecycle. Lead Business Analyst at TechMagic, with a experience in Project Management and QA, mentor, & speaker. Passionate about Business Analysis& Product Design. Whether a startup has formalised a new product’s roadmap or not, every product released will undergo multiple distinct phases of development, from the seed of an idea through to launching it to market and beyond.

5 Must Have Stages of Product Development Lifecycle

In this article, you can know about 5 Must Have Stages of Product Development Lifecycle here are the details below;

According to a new report, the global product development lifecycle management market is set to grow from $33.03 billion in 2021 to $35.69 billion in 2022. As the world economy begins to stabilise after the dust of the COVID-19 pandemic settles, startup companies are once again fuelling their efforts into bringing new products to market to meet new demands.

It is essential for every startup founder to have an in-depth understanding of a product’s development lifecycle as part of the wider product strategy. While a product management team can oversee the day-to-day operations of software product development, a founder needs to have a clear, full-scale picture of every stage that a product will move through during the course of its life.

What is a Product Development Lifecycle?

Product development is the term used to describe the entire process of generating an idea for a product, developing it, and eventually bringing it to market.

While it is impossible to exactly forecast the lifecycle of a product, creating a general roadmap that you expect a new product to pass through during its development will improve a startup’s efficiency, increase cross-team collaboration and help you to gauge what the best next step for your product is.

Looking for web app development services to make the lifecycle of your next digital product unfold as smoothly as possible? Check out TechMagic experience as a Javascript development company for all-in-one digital product development services.

Is product development the same as product management?

Despite how similar they sound, there is a clear distinction between product development and product management.

Product development is the multi-stage process of creating a product and bringing it to market.

Product management, however, concerns the mechanisms of guiding a team through this product development process, which involves overseeing a product’s entire lifecycle.

Both processes are essential components of the overall product strategy development. Product strategy for startups is a fast-evolving field and it is important for founders to stay on top of the latest findings to keep their product strategy competitive.

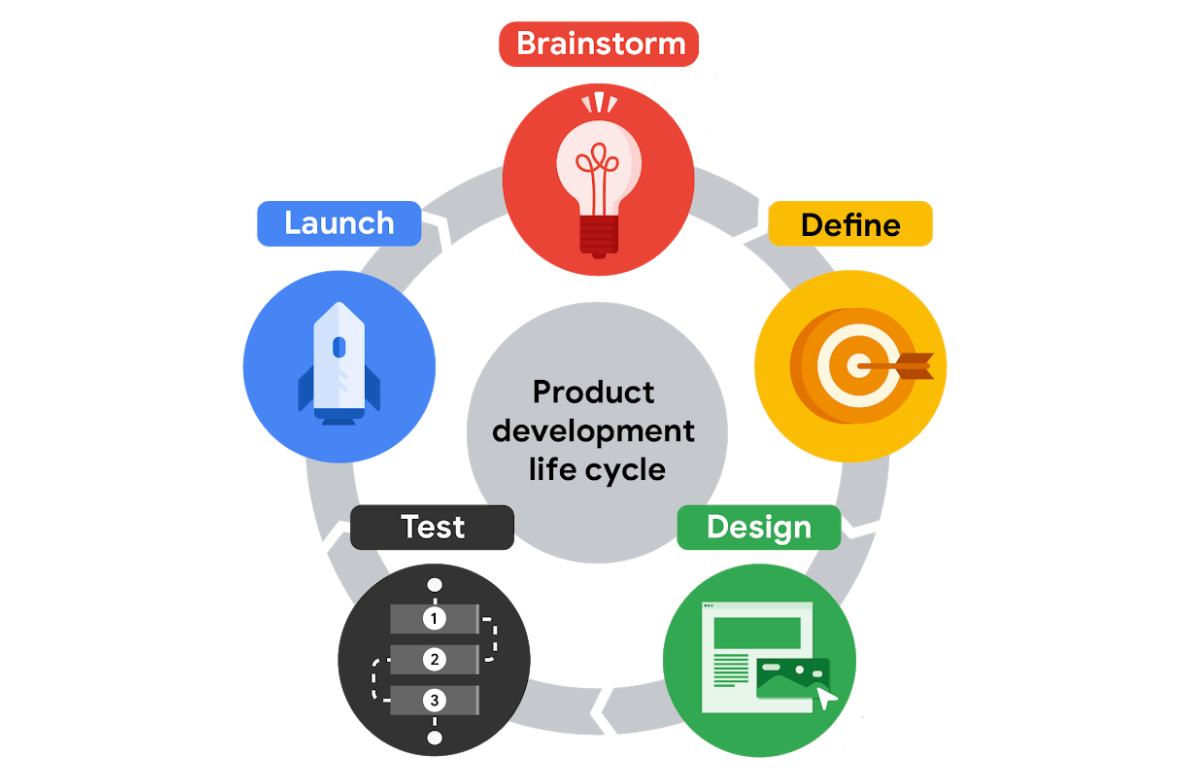

Product Development Lifecycle Stages

There is no universally agreed-upon idea of what the stages of a product development lifecycle ‘should’ look like. Each new digital product a startup creates can take a very different route to launch, and even the most carefully designed plan will not prevent external factors from influencing a product’s lifecycle.

There is, however, a generally accepted series of stages that most products will pass through in their development process. Here is a break-down of the main stages of a product development lifecycle to help you get started with the framework.

Stage 1: Idea Generation

The first stage is idea generation, also known as the ideation stage. The startup team will generate multiple ideas for new products based on multiple factors including market research, the user needs feedback and concept testing.

The aim of this step is to generate as many new and innovative ideas as possible. Don’t spend too much time during this stage on developing the nitty-gritty details and potential feasibility of each idea.

One of the latest trends in digital product development in 2022 is to implement a ‘design thinking’ approach to your idea generation process. Design thinking ensures that startup teams take a user-centric approach to problem-solving, and first requires a deep, human understanding of your target user and their needs.

Here are some starting points to consider during this stage while letting the creative juices flow:

User Personas: What kind of user or customer are you looking to build a product for? Which problems might they encounter in their everyday life? Answering these questions will help you to build an ideal user persona.

SWOT Analysis: Try evaluating the strengths, weaknesses, opportunities and threats of each idea. This is a quick way to flesh out each concept and allows for easy comparison between ideas.

Existing Product Portfolio: Taking a critical look at your startup’s existing product portfolio could help spark ideas for new products. What do your current products do well? What could be improved? How could a new product complement this line-up?

Stage 2: Idea Screening and Refinement

The second stage is to evaluate the ideas you have generated and narrow the pool down to a few select choices.

Deciding which product ideas are worth pursuing is not an easy process. During this stage, you should consider some of the more detailed elements of each idea:

Cost and Pricing: How much would each idea cost to develop? What might a pricing strategy look like for each product? It’s never too early to involve your financial team in the decision-making process.

Competition Evaluation: Conducting an in-depth competitor analysis will help determine the potential product-market fit of each idea.

Marketing Strategy: Mapping out a potential marketing strategy for a new product can help to pin down its Unique Selling Point. What sets your product apart from the rest?

Stage 3: MVP and Concept Validation

Once you’ve settled on two or three product ideas, it’s time to start testing. It is vital to build a minimum viable product, or MVP, as soon as possible. An ‘MVP’ is the earliest version of a product that is released, with just the essential features that are necessary for a user to begin testing it.

A recent Forbes article has shown that 85% of products fail when companies don’t talk to their users. The sooner you can create an MVP for your product, the sooner you can start that crucial dialogue with potential users.

The aim of this stage is not to create a fully-fledged, finished version of the product. Concentrate your efforts instead on creating the most basic iteration of the product as quickly as possible, and release it immediately to start receiving user feedback.

For example, the web app Facebook started life as a bare-bones MVP in 2004. True to its name – ‘face – book’, the social media platform was first released as a simple web directory containing all the names and faces of students in a university.

Stage 4: Product Optimisation

The next stage of software product development is to act on user testing feedback and optimise your product accordingly. This is an iterative process- every time you make a change to your product, or add a new feature, test the new version again and collect more feedback.

If you’re unsure what exactly to ask your users during the testing phase, here are a few ideas of useful data points to collect:

Potential Use Scenarios: Does this product solve any problems the user currently encounters in their life? In what kind of situation might they consider using the product?

UX/UI Design: How easy is the product to navigate for a first-time user? Consider asking the user to try completing different tasks within the product, and then ask them to rate how easy or difficult they found the experience.

Pricing Strategy: How much would the user be willing to pay for this product? Do they already pay for any other products that fulfill a similar purpose?

Continued optimisation of your product increases the chance that it will eventually achieve product-market fit. The term ‘product-market fit’ describes a successful scenario in which a startup’s target users are purchasing, using and sharing the company’s product enough to sustain that product’s profitability and growth.

Stage 5: Product Launch

After several rounds of testing and optimisation, your product will at some point be ready to launch to market.

You might want to release all features of the product at the same time, or your product might benefit from a phased launch. A phased product launch is a progressive rollout of a new product and its features, to allow for continued iteration and fine-tuning of the product. A product launch will also usually coincide with the rollout of the product’s marketing strategy.

Iterative Development in the Product Lifecycle Process

The final release of a product does not necessarily mark the end of the product development lifecycle.

The use of iterative development in creating a new product means that user testing and optimisation continues even after market launch. Product lifecycle development is not always a linear process, and startup teams might return to the user testing stage at multiple points in the journey. Once a product has been launched, constant evaluation of product analytics can provide useful insights on how individual product features are performing.

An iterative approach to the product development lifecycle is less risky. It ensures that you never have to be fully committed to one version of the product and leaves more space to act on user feedback and adapt the product accordingly.

Examples of the Product Development Lifecycle

Now that we have a better insight of the product development lifecycle, let’s take a look at some real-life examples of the process in action.

Beta Features in Figma

Figma is one of the most widely-used web applications among designers to create and collaborate on interface designs.

Having launched in 2012, Figma’s mission was to make design accessible to everyone, and they regularly released new product features to make the design process easier for users.

Even though Figma has now successfully developed into the most competitive option on the design web app market, the lifecycle of its product development is still ongoing. On this page, Figma lists details of all of the upcoming additions to the design tool that are currently in beta mode. An iterative rollout of beta features helps the Figma team to receive user feedback on each one, and improve them accordingly.

Instagram Reels

When Instagram launched in 2010, the platform focused solely on image sharing between users. After the explosive success of the video-sharing platform TikTok a decade later, Instagram began to lose some of its competitive edge.

In response to the increased demand for video content by social media users, Instagram’s parent company, Meta, launched its ‘Reels’ feature in 2020. Users could now easily create, watch and share short-form video content in a dedicated new section of the app. Also check Payroll Taxes

Despite the longevity and celebrated success of Instagram, it is still passing through the product lifecycle to this day. New and innovative features are still being tested, optimised and launched to ensure the web app remains competitive in a fast-moving market.

How can I use the Product Development Lifecycle in my startup?

All start-up founders can implement the product development lifecycle into their product development process. The whole team can have their say in developing a basic framework for what the ideal lifecycle of a new product release would look like in their company.

As a startup founder, you can even apply the principles of the product development lifecycle to products that are already in their post-launch phase. The 6-stage process outlined above does not necessarily need to start from Stage 1. Whenever you add a new feature to your product, track its progress through the testing, optimisation and launch phases to gain a clearer idea of the next best step for your product.

Who is involved in the product development lifecycle?

An essential component of the product development lifecycle process is that everyone in the startup team should be involved in all stages of the journey.

In addition to the founder and CEO, here’s who else should play a role:

Product managers: A product manager will oversee the entire lifecycle of the product, ensure that transitions between stages are smooth, and improve communication across the team.

Designers: The design team will play a major part in every stage of the process, from sketching initial mockups during idea generation, to completing the final design of the product before its launch.

Web developers: Since the development team will be responsible for the actual building of the product, it is essential that they contribute to important decisions concerning which features should be added and when.

Sales and marketing: Both the sales and marketing strategies for the product will need to adapt and improve just as quickly as the product itself does.

Stakeholders: Senior management may need to give final approval to a product before its launch.

A key benefit of using the product development lifecycle framework is that it will improve cross-team collaboration within your startup. Since the process demands that the whole team is working from the same roadmap and towards the same goals, increased inter-team communication will become essential.

Benefits of understanding the Product Development Lifecycle

In addition to improving cross-team collaboration, developing a clearly defined product lifecycle can provide many tangible benefits to your startup and its products.

Increased product quality

One of the most obvious benefits of using the product development lifecycle framework is that the product itself will be of higher quality.

The iterative nature of the process means that the product is always improving and that there are regular opportunities for evaluation and feedback.

Continuous user testing across all stages of product development ensures that the product is solving a real-world problem that users are encountering, and increases the likelihood of successful product-market fit.

Increased efficiency

A clear, step-by-step process for product development can increase the efficiency of your startup in multiple ways.

Firstly, a product’s time to market is reduced drastically. The focus on releasing a minimum viable product as soon as possible prevents months, or even years being wasted on developing a product without getting any real-life user feedback on it.

Secondly, the product development lifecycle increases the cost efficiency of a product. In-depth user research ensures that no money is wasted on adding features to a product that users don’t actually want or need.

A clear product roadmap reduces costs associated with common product development mistakes, such as launching a new product without extensive user testing.

Smoother development of future products

The positive effects of optimising the lifecycle development of a product can be long-lasting. Fostering increased collaboration across teams can improve all cross-team work going forward, and the lessons learned from adhering to a product development process can be applied to all new product lifecycles in the future.

Troubleshooting the Product Development Lifecycle Process

No matter how well-designed the lifecycle development of a product is, there is always a high chance that some parts will not go to plan. Here are our top tips on troubleshooting some of the most common problems you might encounter during the product development process.

User testing doesn’t go as planned

One element of product development that a startup team has little control over is the outcome of user testing.

It is impossible to predict what users will think of a new product before testing has begun. If there is a particular feature that is testing poorly with users, it can be hard to accept that the feature may not be right for the product, or might require drastic changes.

All feedback is useful feedback during the user testing stage. Even if the outcome seems negative, listening carefully to feedback and acting on it accordingly will always serve to improve the product.

Product lifecycle doesn’t evolve according to plan

One tip that is important for founders to remember is that the product development lifecycle is not necessarily a linear process. No matter how carefully the product’s lifecycle has been planned out, there is a high probability that the process will not unfold exactly as expected.

Remain flexible during the process, and be ready to adapt the course of a product’s lifecycle at several points throughout the journey.

FAQs

What is a product development lifecycle?

In short, the term ‘product development lifecycle’ describes the multi-stage process a product will pass through during its life, from inception to its eventual maturity.

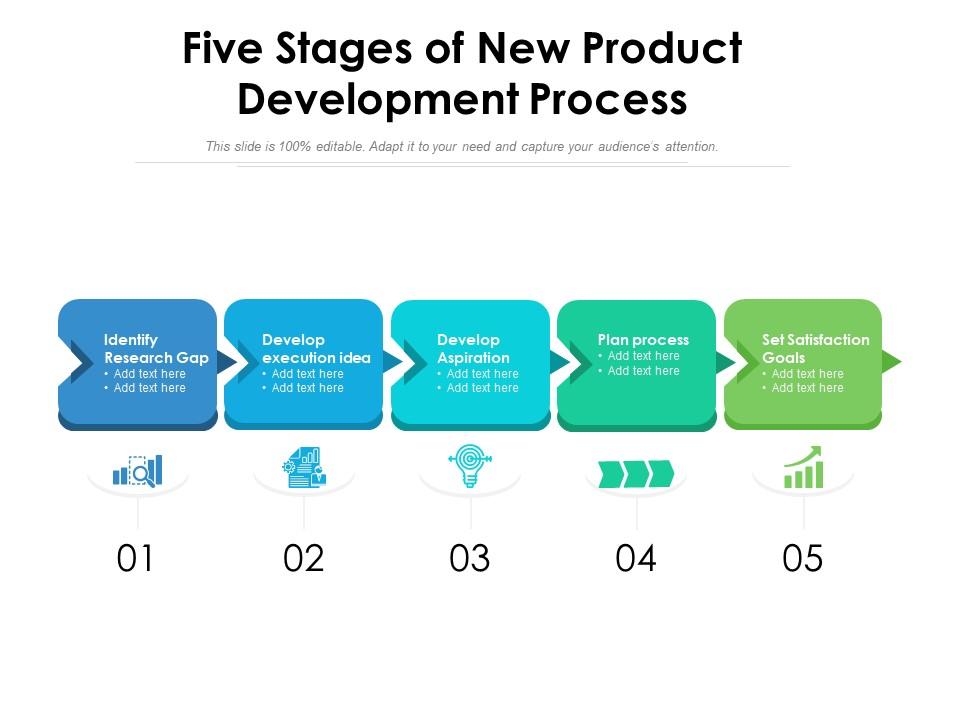

What are the 5 stages of product development?

The product development cycle can be condensed into 5 short stages, summarised as so:

- Ideation

- Idea Screening

- Concept Development

- Prototyping and Refinement

- Product Launch and Iteration

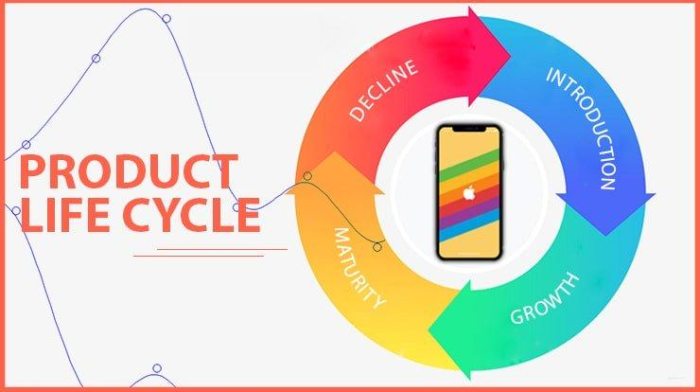

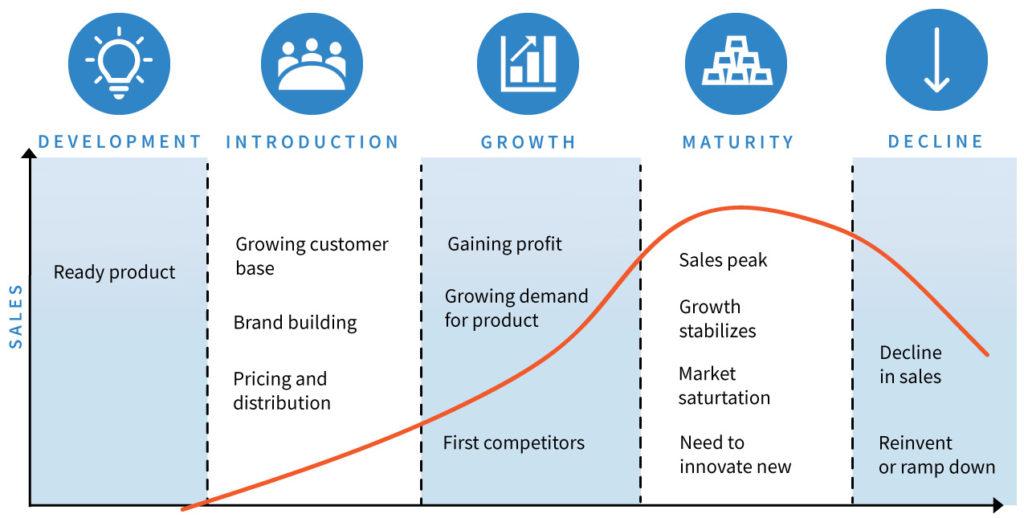

What are the 7 stages of a product lifecycle?

Another popular take on the product development lifecycle involves 7 distinct stages. This approach extends beyond the product launch stage, and includes the maturity and eventual decline of a product.

- Plan

- Develop

- Launch

- Growth

- Maturity

- Decline

- Retirement

What are the 8 stages of successful new development development?

Another frequently-used approach to the product development process involves dividing the journey into 8 separate steps.

- Idea Generation

- Idea Screening

- Product Development Process

- Marketing Strategy

- Business Model

- Manufacture

- Branding

- Product Launch